Silver Bulletin #2

November 14th 2020

THE SILVER BULLETIN #2

A weekly(-ish) newletter on tech, investments and living better by Hitesh Suresh.

#FUN FIND OF THE WEEK

#COVID

Shocker! Sounds like we might have a vaccine after all! Bravo Pfizer. First Viagra, now this!

What’s fascinating is that Pfizer didn’t take any government funding for their vaccine. Their CEO wanted to “liberate [their] scientists from any bureaucracy.”

Here’s an excerpt from their interview.

I completely agree with this move. Pfizer went all in and had the most skin in the game of all the pharma companies out there.

It’s only fitting that they now capture the lions share of the profits. Fortune favours the bold.

#MARKETS

Huge reactions from the markets on this vaccine announcement.

Tech stock of course, took the biggest beating.

$ZM: -17.4%

$DOCU: -14.7%

$ZS: -14.2%

$CRWD: -10.8%

$VEEV: -10.2%

$SMAR: -9.6%

$SNOW: -9.5%

Meanwhile, travel related stocks surged:

$DIS: +11.4%

$RCL: +24.6%

$EXPE: 21.5%

These travel stocks though, are merely catching up to their pre-covid market prices. Tech stocks though, even with this week’s pull back, are at all time highs.

Covid has accelerated tech adoption by years. 12 months ago, if you had told me my mom would be a Zoom expert by now, I wouldn’t have believed you. And yet, here we are.

This really is tech’s moment. I’m still super bullish on the long term prognosis for these companies. It’s just getting started.

#STRATEGY

On the importance of choosing the right industry to be in…..

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

– Warren Buffett

Stealing a graph from this fantastic McKinsey article that ranks industries by their profits. Unsurprisingly, software is far ahead in the lead.

That graph though, doesn’t capture the oligopolistic behaviour of industries. It lists “average” profits per firm. Most profits though, especially in software, are concentrated in the #1 player.

Being #1 really matters in software. eg. Does Bing’s search engine even matter?

To quote contemporary rhythmic poet, Cornell Haynes Jr (aka. Nelly), “#2 is not a winner and #3 nobody remembers”

#HAPPINESS

I listened to a great podcast last week between Tim Ferriss and Naval Ravikant.

It’s filled with so much great wisdom. One of the best podcasts I’ve heard this year.

My biggest takeaway was on thinking long term:

- Thinking long term solves many of life’s problems

- Thinking long term about health means you’ll consistently be eating healthy as opposed to filling your body with tasty but harmful junk food.

- Thinking long term about friendships means you’ll always treat the people around you with deep loyalty and consistently cut away people who are toxic.

- Thinking long term about work means you’ll engage in putting in the hard miles now for your career foundations as opposed to punting for short term opportunistic gains.

- Thinking long term about investing means you’ll be disciplined in only picking stocks that have strong fundamentals as opposed to being carried away by FOMO and buying the current hottest stock.

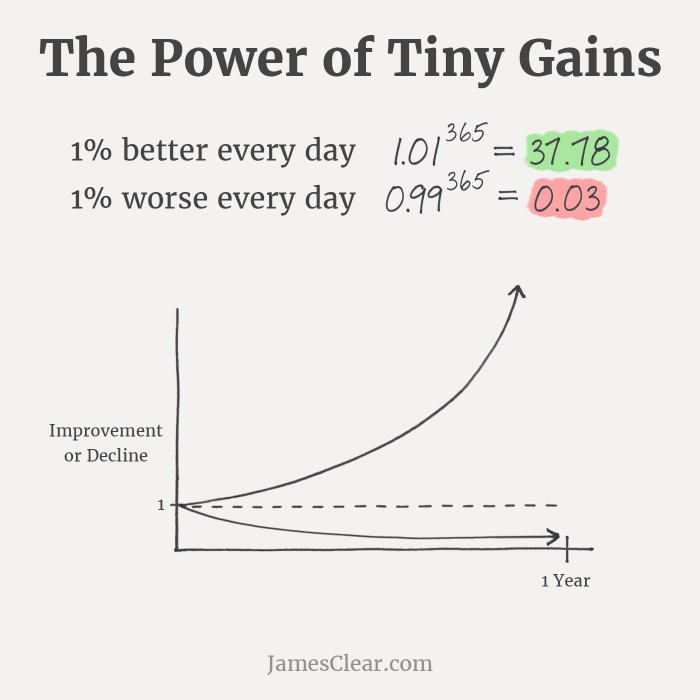

James Clear visualised it best with this graphic.

The issue with thinking long term is that it’s not popular. Humans are hard wired to be dopamine-chasing-myopic-thinkers. When you start being “disciplined”, you’ll be mocked for being crazy. (we all have that one friend at the dinner table who we laugh at for having a healthy salad while everyone else eats steak)

But here’s the irony. We mock that long term thinker because secretly, we know we outta be doing it as well. But we lack the discipline. Our disdain is a form of projection. When really, it’s us who should be laughed at, not them.

So the next time you see someone being disciplined, encourage them. Celebrate their bravery. It’s a lonely but honourable path. 🙂

Hope you have a lovely weekend, my friends. Make it 1% better. 🙂